HOW DOES A HIGHER CREDIT SCORE HELP HOMEBUYERS?

A credit score is one of the critical factors that lenders consider when determining whether to approve a mortgage application. The score reflects a borrower’s creditworthiness and financial history, which indicates the likelihood of paying back the loan on time. A high credit score is an indicator of a responsible borrower and shows that the borrower has a history of making timely payments on their debts. A low credit score can make it challenging to obtain a mortgage, or the borrower may receive higher interest rates and less favorable loan terms.

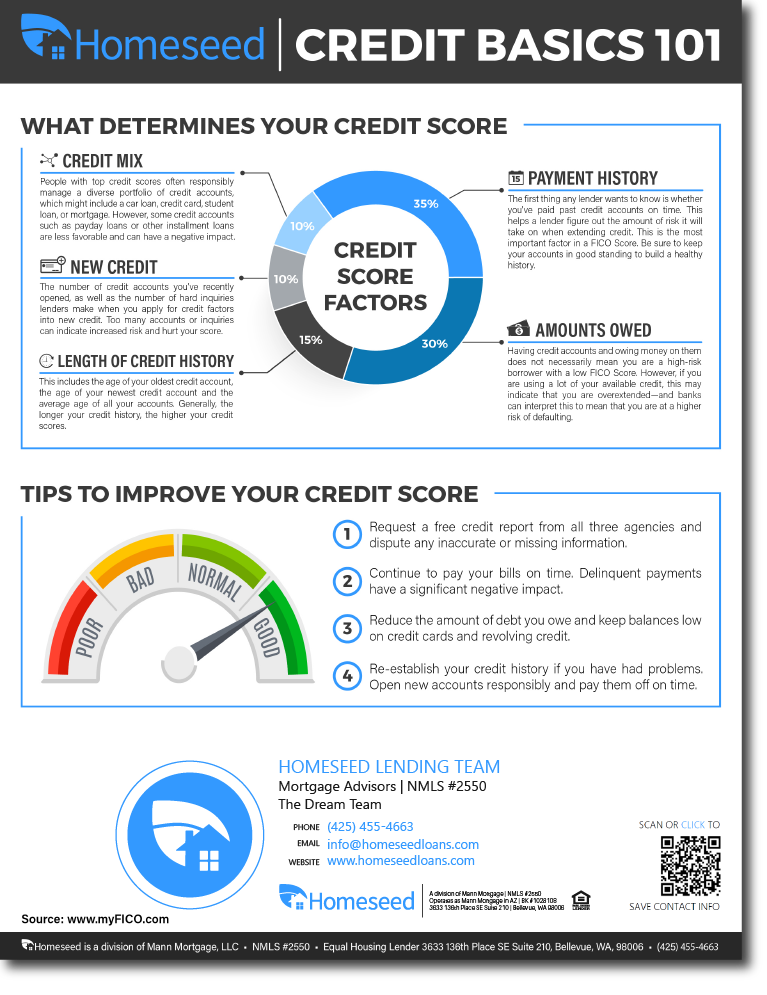

Furthermore, a high credit score not only makes it easier to obtain a mortgage but can also help borrowers secure a more affordable mortgage loan. Lenders offer lower interest rates and better terms to borrowers with higher credit scores, which can result in significant savings over the life of the loan. Even a small difference in interest rates can add up to thousands of dollars in savings over the long term. Therefore, it is crucial to maintain a high credit score by consistently paying bills on time, keeping credit card balances low, and avoiding taking on new credit until after the mortgage has been secured. Check out the flyer below for more tips on maintaining and keeping your credit score high!