Welcome to Homeseed’s Comprehensive Winter Mortgage Report, your guide to navigating the current landscape of the mortgage market and seizing opportunities in the real estate market! In this detailed report, we delve into crucial elements influencing the market, including the recently released 2024 loan limits, the impact of inflation and labor market dynamics, predictions regarding the trajectory of interest rates, insights into home values and appreciation trends, and most importantly, the window of opportunity awaiting potential buyers. Read on to equip yourself with essential knowledge for making informed decisions in the real estate sphere.

New Loan Limits

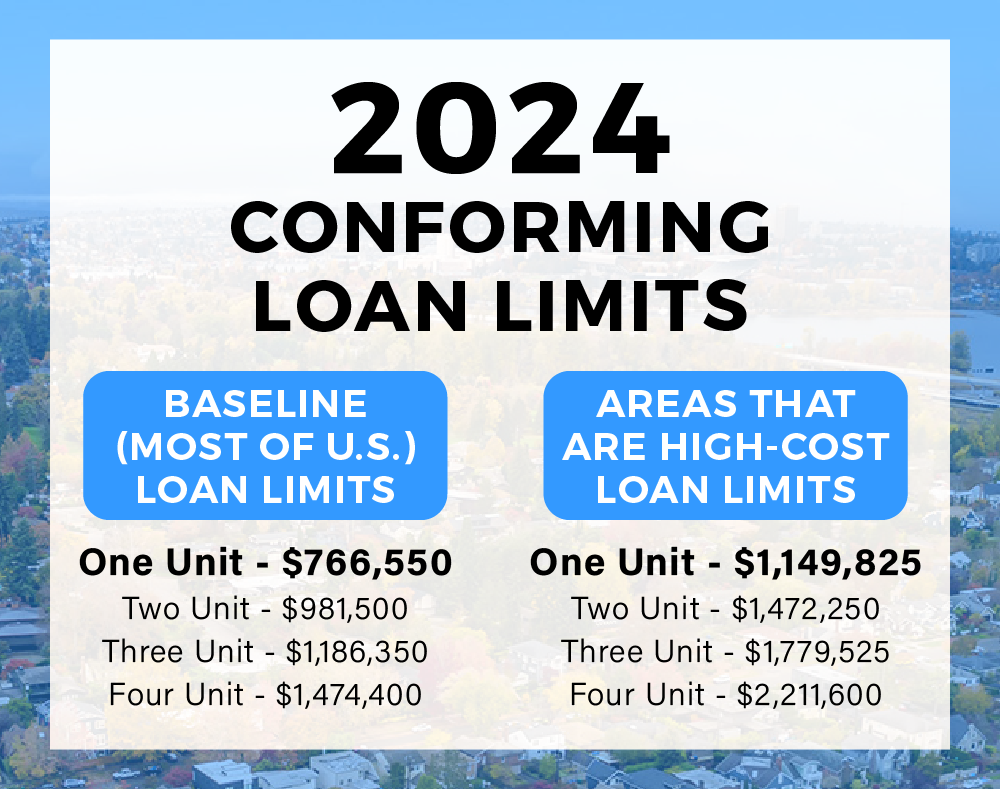

Annually, the Federal Housing Finance Agency (FHFA) sets conforming loan limits for the forthcoming year based on the November House Price Index (HPI), reflecting home price appreciation data. For 2024, the baseline conforming loan limit will rise to $766,550, marking a $40,350 increase from the 2023 limit of $726,200. This substantial increase aims to facilitate greater access to credit for home buyers in markets experiencing upward home price appreciation.

Inflation & Labor Market Data

The recent softening in economic data and the labor market holds significance for the inflation outlook and its potential impact on mortgage rates. A weakened economic landscape tends to alleviate inflationary pressures as reduced consumer spending and constrained demand mitigate the upward push on prices. This was reflected in the Personal Consumption Expenditures (PCE) report for October which saw both its headline and core rates continue to fall year-over-year.

Moreover, a softer labor market with elevated unemployment and a reduction in job gains leads to a slowing of wage increases and less consumer spending. We are likely seeing the intended effects of the Federal Reserve (Fed) rate hikes take effect.

Where Are Rates Headed?

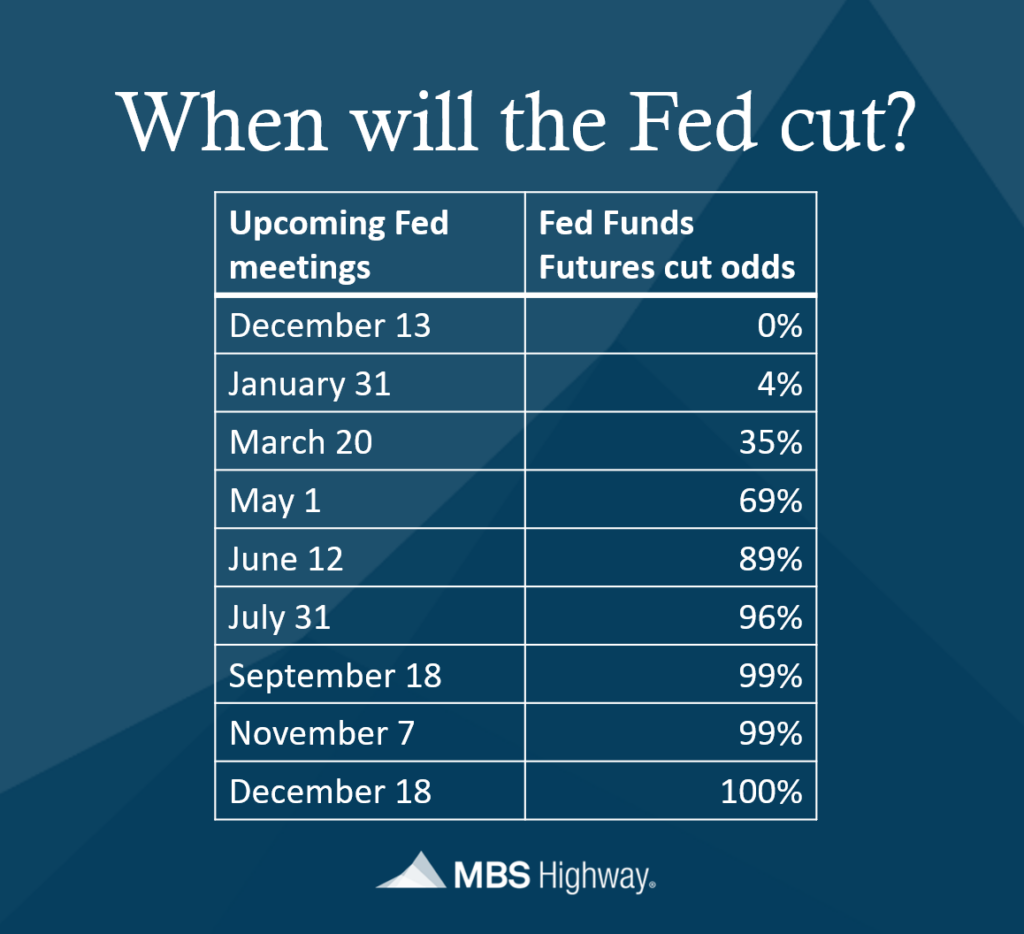

Recent trends we just discussed indicating lower inflationary pressures alongside a weakening job market have significantly increased the likelihood of a potential cut for the Fed Funds Rate cut in the coming six months. The diminishing inflation data, coupled with sluggish economic activity reflected in the softening job market, have increased expectations for the Fed to consider easing its monetary policy stance. A cut in the Fed Funds Rate becomes a tool to manage economic growth and inflation to maintain its 2% target.

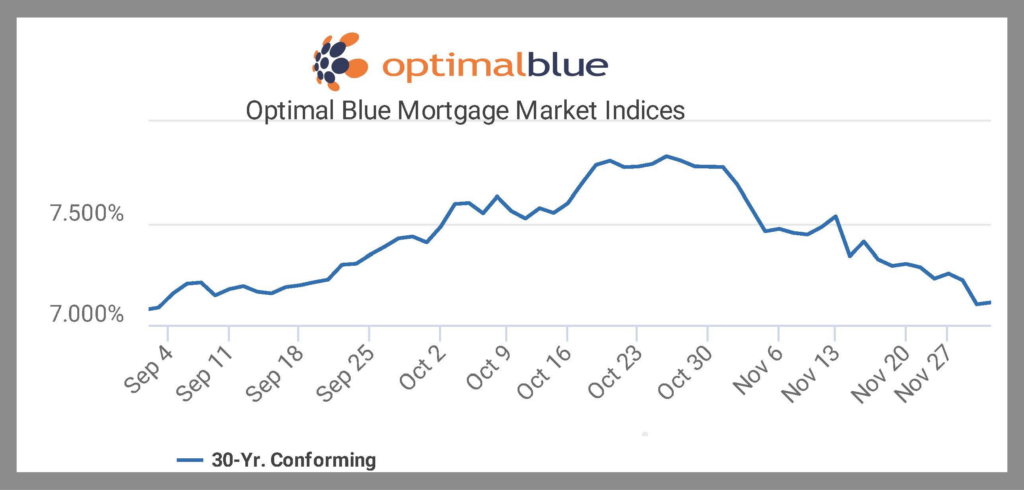

As the Fed lowers interest rates or signals a more accommodative policy, it directly influences downward movement in mortgage rates. This is evident in the recent drop in rates throughout the month of November. With many leading indicators pointing towards a weakening economy and job market, we are likely to see this downward trend in rates continue into 2024.

Home Values & Appreciation Trends

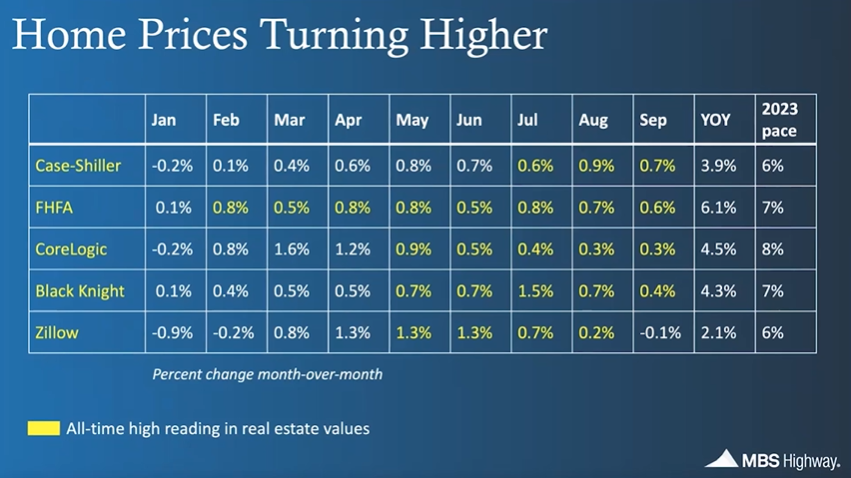

Amidst the current real estate landscape, home values continue to remain stable and exhibit consistent appreciation. In fact, five of the most notable home price indices highlight an annualized appreciation of 6% or higher through the end of 2023, underscoring the resilience and upward trajectory of property values. This has been primarily fueled by a shortage of home inventory. Forecasts for 2024 echo a continuation of this trend, as the imbalance between supply and demand remains a pivotal factor driving the market. The persistent shortage of available homes, compounded by a lag in housing starts failing to meet the pace of household formations, serves as a primary catalyst in the sustained appreciation of home values. This disparity between the growing demand for housing and the insufficient supply of available properties is anticipated to perpetuate the trend of appreciating home values well into the upcoming year where homeowners will gain significant equity.

The Current Window of Opportunity for Buyers

In the current winter market, a unique window of opportunity presents itself for prospective homebuyers, fueled by multiple favorable factors poised to shape the real estate landscape. Forecasts indicating an anticipated decline in mortgage rates set the stage for increased affordability, thereby widening the pool of potential buyers. As rates fall, accessibility to homeownership becomes more attainable, likely leading to heightened competition and subsequent upward pressure on home prices. Furthermore, the increase in new loan limits significantly contributes to affordability by granting buyers access to higher financing. Seizing this moment presents an advantage for buyers as purchasing now grants the advantage of entering the market ahead of the projected surge in competition. Moreover, buyers who secure properties during this time can capitalize on potential equity gains, with home values expected to appreciate into the upcoming year. Additionally, with the prospect of lower rates in the future, buyers have the option to refinance when rates decline further, maximizing financial benefits while ensuring a strategic investment in a burgeoning market. Hence, acting swiftly in the current market not only secures a foothold in less competitive conditions but also positions buyers to potentially gain from future equity growth and favorable refinancing opportunities.