Welcome to Homeseed’s 2024 Mortgage & Real Estate Forecast! As we enter the exciting year of 2024, the anticipation and speculation surrounding the mortgage market and housing industry have prospective homebuyers carefully watching. In just the last three years, we’ve gone from seeing all-time low mortgage rates to some of the highest mortgage rates in the last two decades due to significant global events and economic shifts. To better understand what potentially lies ahead for this year, let’s dive into a forecast for the mortgage market and housing industry in 2024.

Inflation: The Driving Force for Mortgage Rates

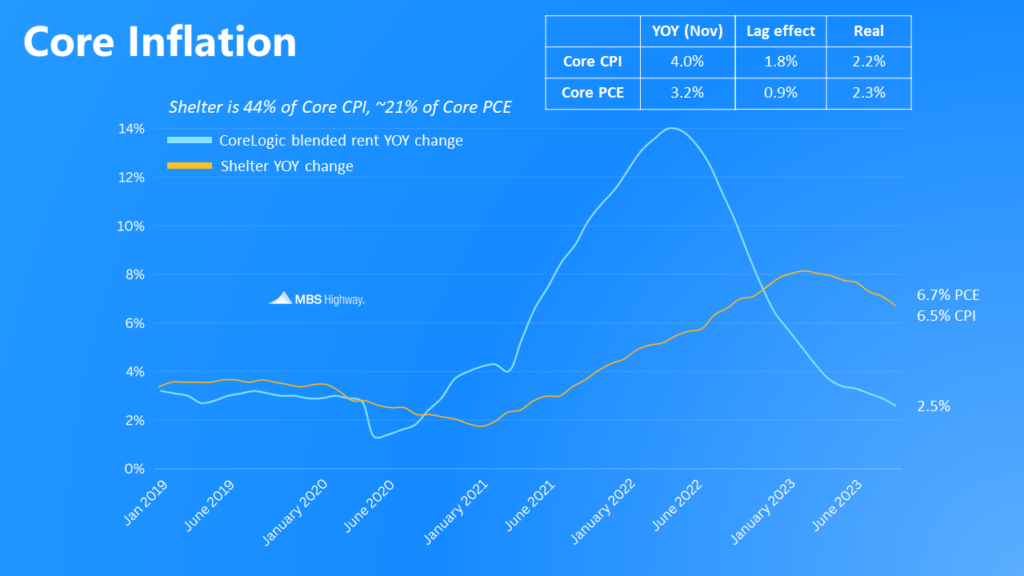

Inflation has emerged as a pivotal factor shaping the mortgage market. After reaching a near 40-year high of 5.3% in March 2022, Core Personal Consumption Expenditures (PCE) has been on a gradual decline and now hovers at 3.2%, which is near the Federal Reserve’s (Fed) goal of 2%. Given the improvement on inflation, the Fed signaled they would begin rate cuts to their Fed Funds Rate before reaching the 2% target in hopes of easing into its inflation goal with minimal negative effects to the economy. With shelter accounting for 21% of Core PCE, CoreLogic’s most recent measure of shelter costs showed a 2.5% year-over-year increase in their real-time blended rents data. This suggests a continued improvement for inflation lies ahead as the shelter data used by the PCE report lags the real-time shelter data, and the markets are now predicting the first rate cut by the Fed as early as March 2024.

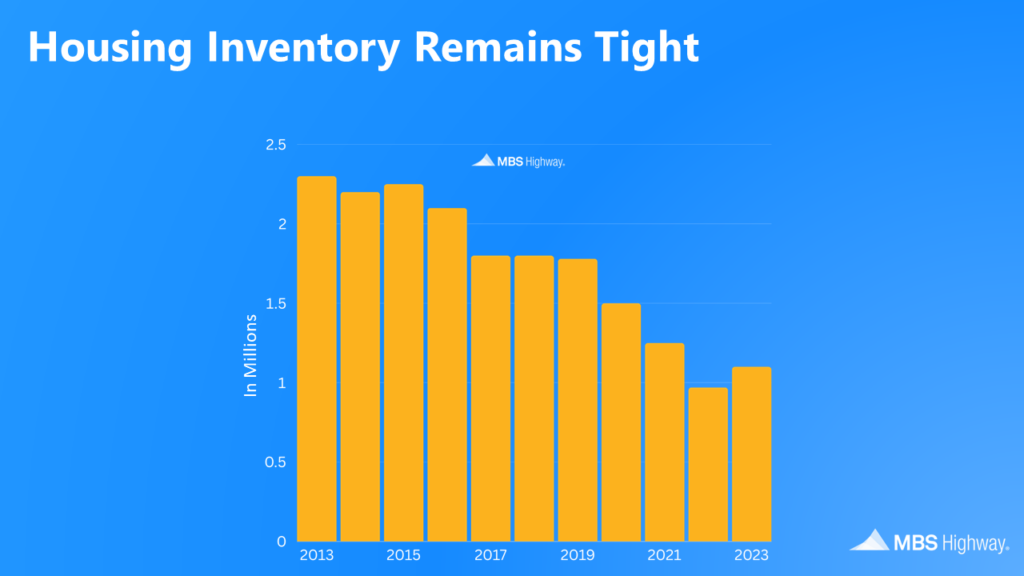

Supply and Demand: Limited Inventory Pushes Home Prices Higher

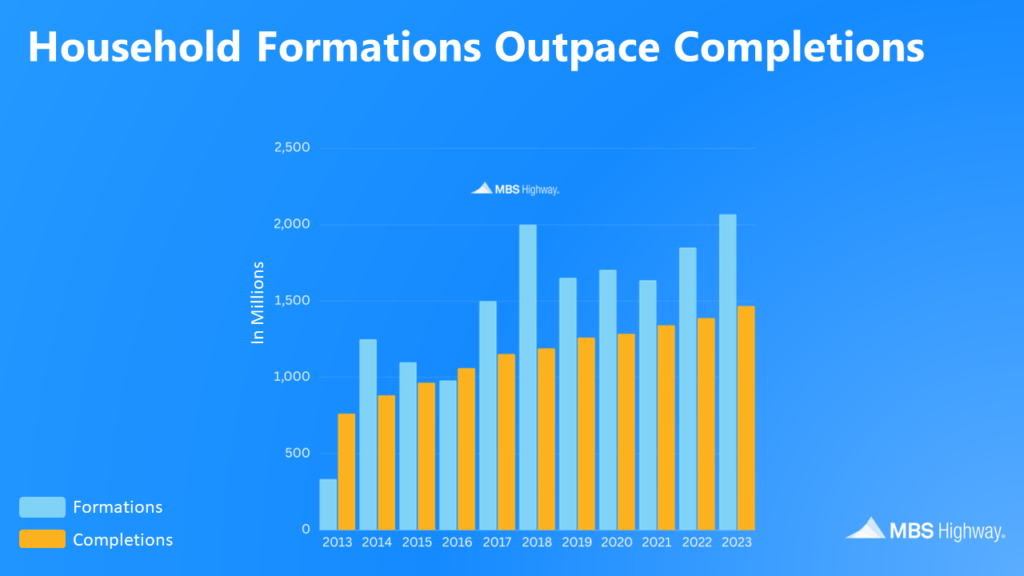

The housing market continues to grapple with enduring challenges in inventory shortage, fueling a steady increase in home prices. Despite efforts to address the housing deficit, housing starts persist below household formations, indicating a sustained scarcity of available homes for sale coming to the market that is unable to meet the escalating demand. This ongoing imbalance between the supply of homes and demand from buyers will likely intensify competition if mortgage rates continue to come down, leading to the possibility of bidding wars and soaring prices once again.

Mortgage Rate and Real Estate Forecasts

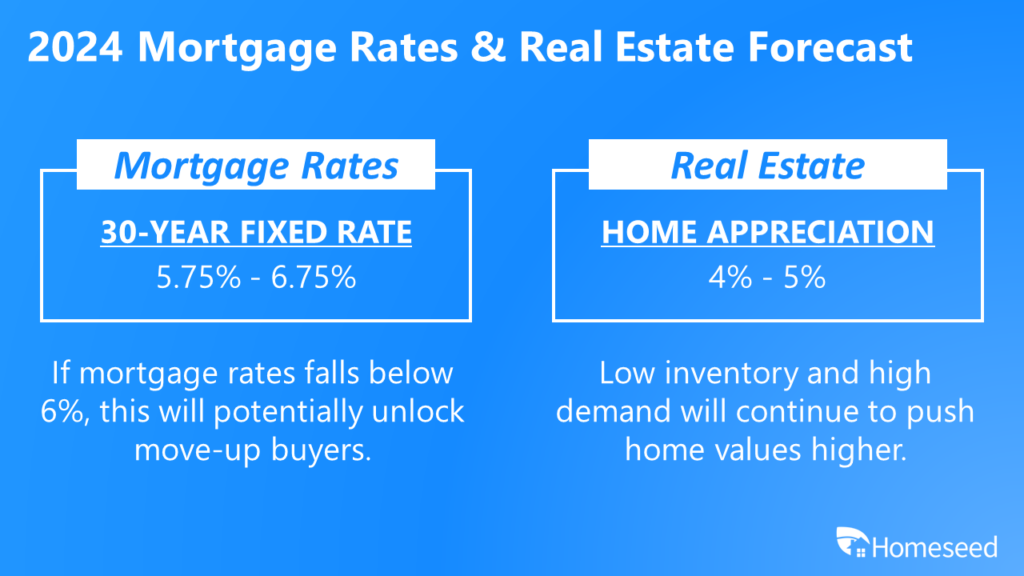

Given the trajectory of inflation, we forecast the 30-Year Fixed Rate Mortgage to fluctuate between a rate range of 5.75%-6.75% throughout 2024. If rates fall below 6%, this will potentially unlock move-up buyers who are current homeowners that want to upgrade their homes.

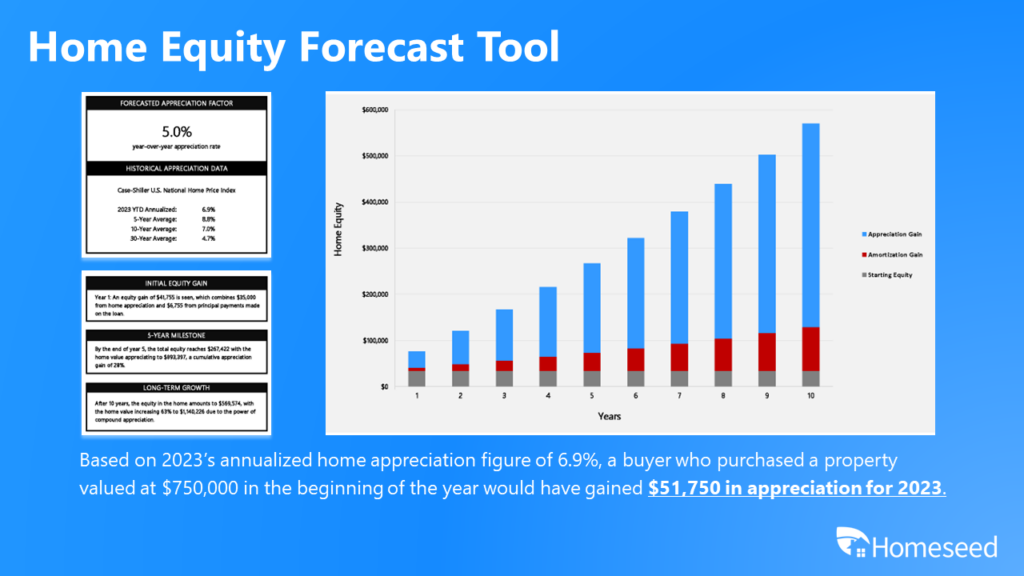

For home price appreciation, we forecast home values to increase between 4-5% in 2024. Values should stay strong as demand will remain high due to more households being formed than homes coming to market.

Seizing the Opportunity: A Time for Homeownership to Build Wealth

As we navigate the intricacies of 2024, this period stands as an opportunistic time for prospective homebuyers. With the likelihood of interest rates coming down and home prices on a continued ascent, buyers can consider the strategic move of securing a home now and later benefiting from potential refinancing opportunities in the near future. Here at Homeseed, we offer a Home Equity Forecast tool, shedding light on the significant wealth-building potential through home appreciation and amortization. It emphasizes that homeownership is not merely about costs and interest rates but extends to the concept of a home evolving into one of your most substantial investments for building wealth.