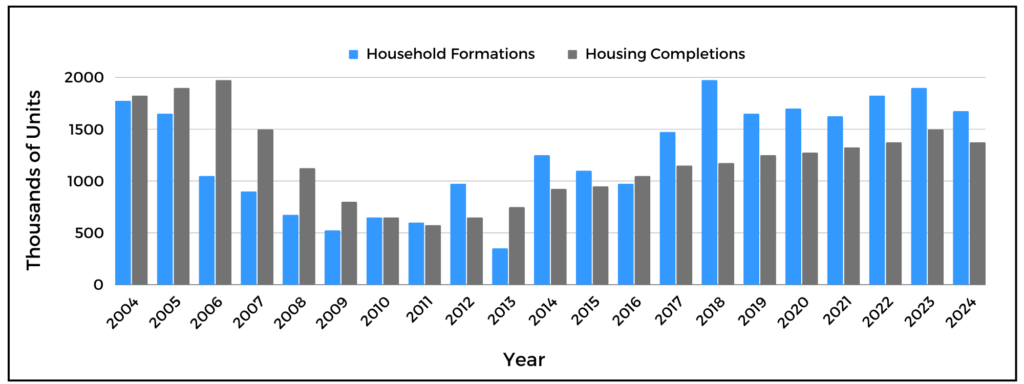

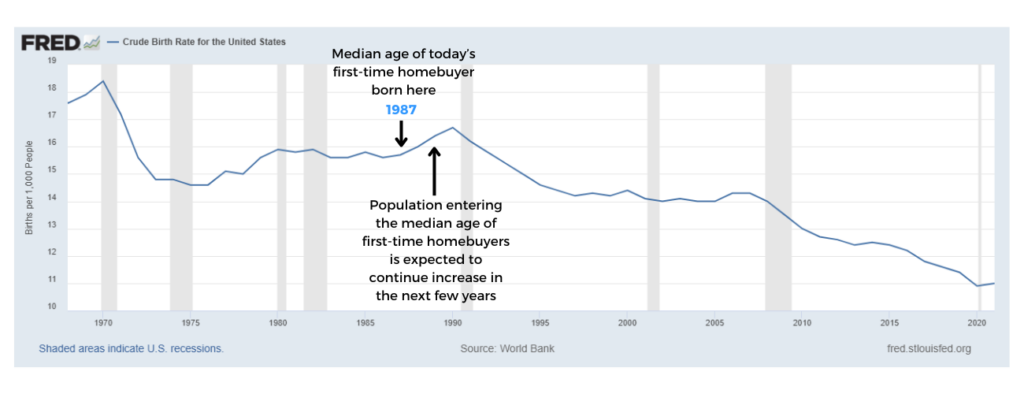

In today’s dynamic real estate landscape, a persistent housing inventory shortage defines the market’s competitiveness. This scarcity arises from two main factors. Firstly, household formations consistently outpace housing completions over the past decade, with projections indicating a continued trend. The growing population entering the median age of first-time home buyers (37 years old) further exacerbates this issue. Secondly, many homeowners are hesitant to sell due to the current higher interest rate environment. While they might have considered upgrading in the past, prevailing higher interest rates anchor them to their current residences. This dual dynamic, driven by increasing household formations and homeowners holding onto their properties, shapes the current sellers market and intensifies competition.

Making Your Financing as Competitive as Possible in the Seller Market

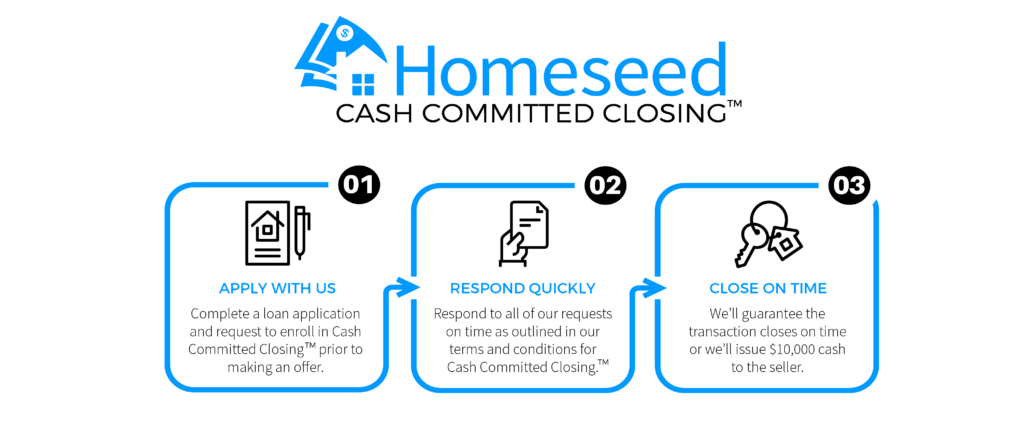

Where time is of the essence, the importance of offering a quick closing cannot be overstated. Enter Homeseed’s Cash Committed Program, a highly impactful tool in the homebuying process. Unlike traditional pre-approvals, this program provides an underwritten credit approval that signifies a more robust evaluation of your application and commitment to financing. The added assurance of a $10,000 guarantee for closing on time not only expedites the process but also builds trust with sellers, making your offer stand out in multiple offer situations.

Homeseed also offers a Buy Before You Sell Program that allows homebuyers to move quickly on the purchase of the new home rather than worrying about selling their current residence. This strengthens their offer on a new property as they are not contingent on the sale of their current home. Buy Before You Sell also offers the option to receive a bridge loan to help cover the down payment on the new purchase or to make repairs to the departing residence.

Create Your Inventory and Build the Home of Your Dreams

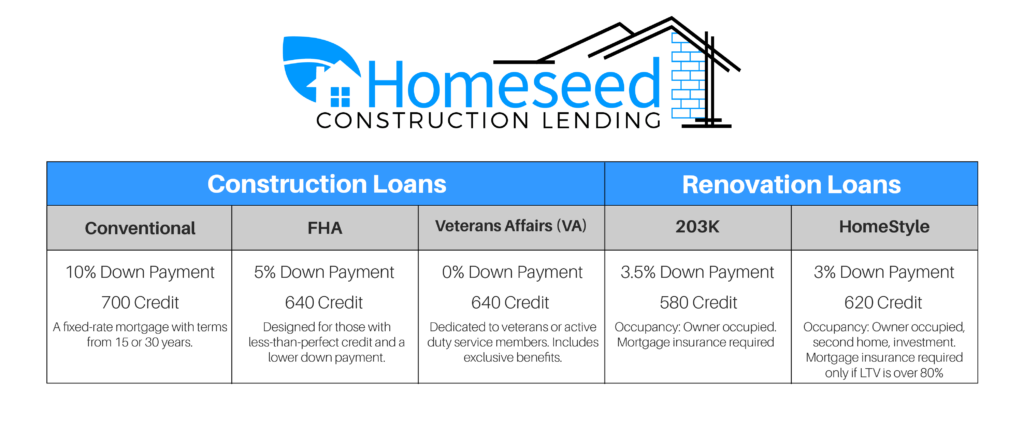

With inventory at an all-time low, homebuyers have also expressed a need to find alternative avenues for homeownership. Building a new home or rehabilitating an existing one emerges as a strategic move. These options often come with the enticing prospect of instant equity post-construction or rehab, where the appraised value exceeds the initial investment. Moreover, with low down payment options, such as 5% with conventional financing or 3.5% with FHA financing, these programs make homeownership more accessible.

It’s essential for homebuyers to adapt and thrive in this competitive market, and a crucial aspect of this is collaborating with a local lender who understands the nuances of the market. Working with someone knowledgeable about the local real estate landscape can provide invaluable insights and pave the way for a smoother and more successful homebuying journey. As you embark on your homebuying journey, consider exploring innovative financing options with Homeseed. The dynamic nature of the real estate market calls for proactive and informed decisions, and Homeseed is here to empower you on your path to homeownership.